Even one unverified director can stop a company’s next confirmation statement or any other filing from being accepted. Companies House identity checks for directors and persons with significant control (PSCs) is coming soon. Every firm working with limited companies needs to understand how they affect routine filings and workflow.

Effective 18 November 2025, all company directors and PSCs need to verify their identity with Companies House. The rules aim to make the register more trustworthy, prevent company identity fraud, and ensure that those controlling UK companies are who they claim to be.

In addition, firms of accountants that file documents at Companies House must now be registered as an Authorised Corporate Service Provider (ACSP).

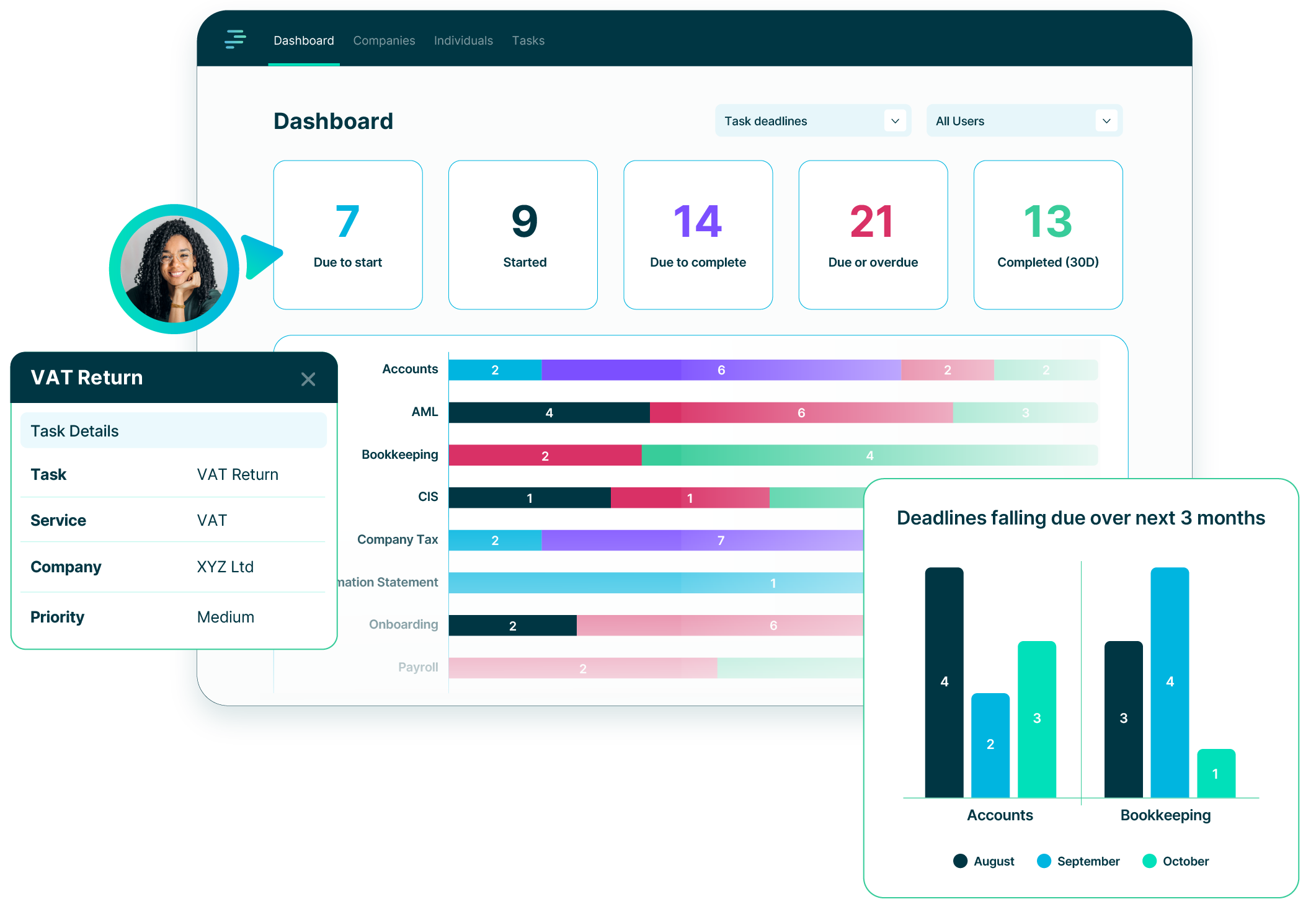

For accounting and bookkeeping firms, these changes add a new layer of compliance to routine filings such as confirmation statements, annual accounts and incorporations. Understanding how the system works and who holds responsibility is essential to avoid rejected filings, delays, or client confusion. These changes also affect how firms use practice management software and other integrated tools for Companies House submissions.

Verification is a two-step process:

1. Identity verification – carried out through either:

2. Personal code – once verified, the individual receives a Companies House personal code to link their verified identity to each company role they hold. Companies House will also display each person’s verification status and due date on the public register.

The personal code is used once when the company files its first confirmation statement after 18 November 2025 and again if that person is appointed to a new company or takes on a new role, such as becoming a PSC in another entity.

This first use of the code creates the link between each verified director and the company record. After that, Companies House will cross-check verification status automatically for future filings, so the code does not need to be re-entered for the same company.

A PSC’s 14-day verification window starts when their requirement is triggered, usually on registration as a new PSC or at the first confirmation statement after 18 November 2025 for existing ones.

If your firm submits confirmation statements, director changes, or company incorporations for clients, you will need to register as an ACSP.

To register as an ACSP your firm must be supervised for Anti-Money-Laundering (AML) purposes by a recognised body such as ICAEW, ACCA, AAT or HMRC. Once registered, you will be able to verify the identity of company directors and PSCs and submit filings on their behalf.

ACSPs must:

The Companies House registration fee is £55. Firms will typically integrate AML and identity verification, using digital ID verification technology (IDVT) or a specialist provider to manage the process.

| Effective Date | Requirement |

| 8 April 2025 | Voluntary identity verification became available. |

| 18 November 2025 | Identity-verification requirements take effect for new directors and PSCs. |

| Next confirmation statement after 18 November 2025 | Deadline for existing directors and PSCs to verify their identity. |

Firms fall broadly into three groups:

a) Bookkeeping and accounts-only firms

If your firm prepares but does not file accounts or confirmation statements directly at Companies House, you do not need ACSP status. You should still ensure that your own company directors are verified and advise clients that their directors and PSCs must complete verification before their next confirmation statement is due.

b) Firms filing manually at Companies House on behalf of clients

If your firm submits Companies House filings for clients, you must register as an ACSP. Only verified officers or registered ACSPs will be permitted to make filings once the new identity verification rules take effect.

c) Firms using software to file accounts or confirmation statements

Many firms now use compliance software to prepare and file company information directly with Companies House. From November 2025, these systems will need to operate through an ACSP environment or an equivalent verified connection that confirms all directors and persons with significant control (PSCs) have completed identity verification.

For most small firms

Most customers I have spoken to are either:

While the legal responsibility for verification rests with the directors of the client company, accountants and bookkeepers who submit filings have a professional responsibility to ensure that every submission is compliant. Before submitting any confirmation statement or company update, firms should confirm that all relevant individuals are verified. This can be checked on the public register, as filings will be rejected if any director or PSC remains unverified.

As usual, some clients will require more follow-up than others, but in practice, many firms will be able to continue working much as they do now. The main change is simply checking that everyone who needs to be verified has done so before filing. Your firm doesn’t need to handle the verification itself unless you choose to; as an ACSP, you simply ensure that every individual has been verified before filing.

Join the growing number of UK accounting and bookkeeping practices using PracticeFlow to stay organised, meet deadlines, and focus on what matters most.