From 6 April 2026, certain clients will need to comply with Making Tax Digital for Income Tax (MTD ITSA). These include:

From April 2026, these clients must keep digital records, submit 4 quarterly updates in each tax year, and make a Final Declaration at year-end. In November 2023, HMRC confirmed that the separate End-of-Period Statement (EOPS) is no longer required. The obligation is now simply quarterly updates plus the Final Declaration.

For accountants and bookkeepers, the core tax rules are unchanged. What changes is the frequency of submissions.

Instead of a single Self Assessment deadline each January, in-scope clients will now generate five submission touch-points per year. That increases the number of deadlines you must track and spreads the workload more evenly across the year.

This shift has real implications for practice capacity. Firms will need to plan how quarterly updates are gathered, who in the team is responsible for preparing them, and how progress is monitored. It is not difficult work in itself, but multiplied across a client base it becomes a significant operational challenge.

To manage MTD submissions you’ll need an Agent Services Account (ASA). This is HMRC’s dedicated digital gateway for MTD, separate from the older agent account used for services like Self Assessment and PAYE. You must use the ASA to link your software and authorise each client for MTD.

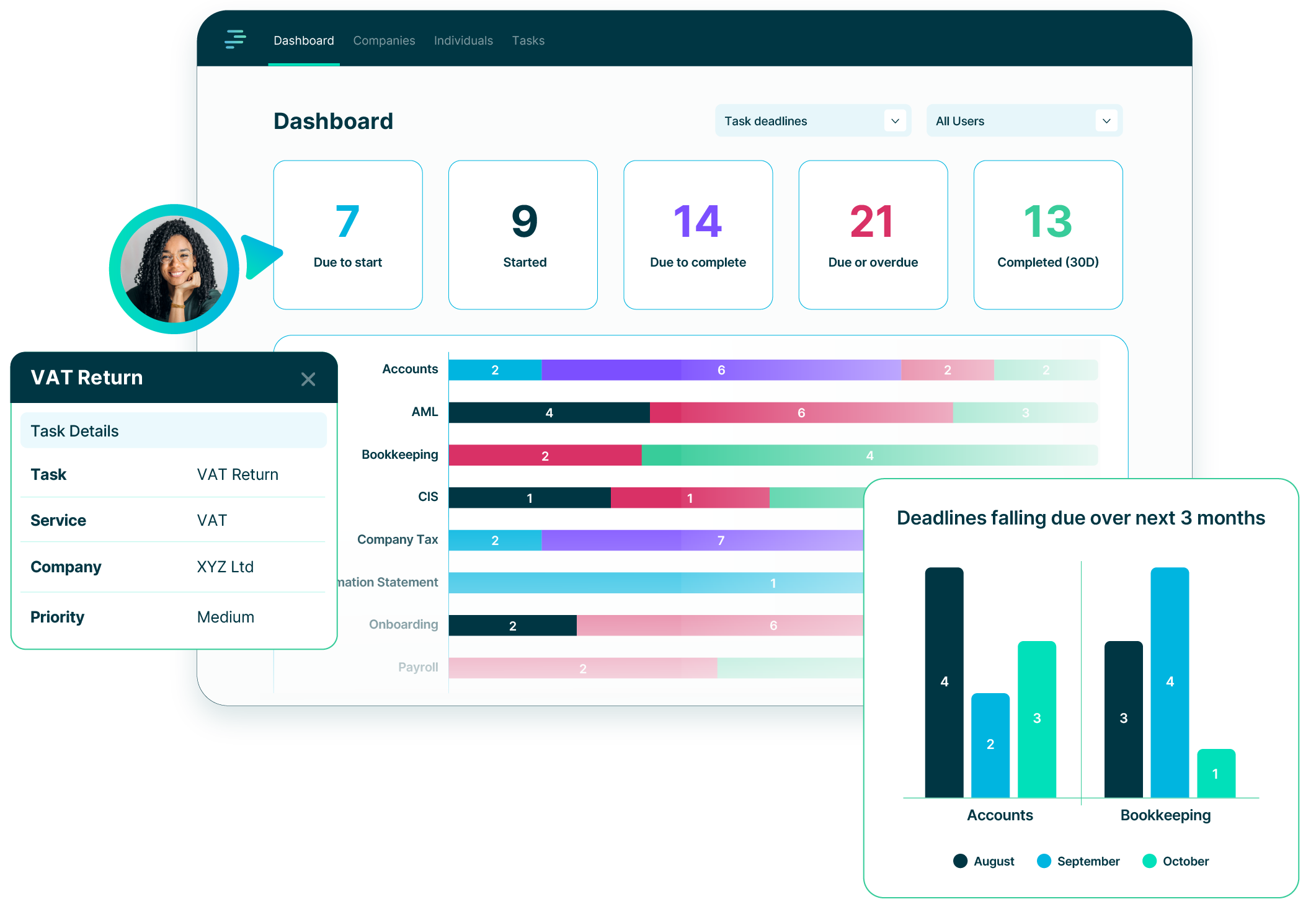

This is where PracticeFlow Smart Task templates make the difference. A template defines the rules around a recurring obligation: when tasks are generated, how often, and for which client type. We recommend using a dedicated template for MTD ITSA. The good news is new templates are quick and easy to create. Once a template is set up, it drives the recurring cycle automatically and can be amended for any future changes

Both Professional and Enterprise plans also include email template functionality, making it easier to request information and remind clients about quarterly obligations directly from within the task workflow.

The introduction of Making Tax Digital for VAT provides a useful comparison. For many firms, VAT compliance was already quarterly, so the impact was more about digital record-keeping than about frequency.

MTD ITSA is different. For sole traders and landlords who previously filed once a year, quarterly reporting represents a substantial operational shift. Firms that already felt January pressure for Self Assessment could now face a similar workload four times a year.

There is also a positive angle. As quarterly reporting approaches, many sole traders and landlords may seek professional help for the first time, preferring to outsource rather than manage digital records and submissions themselves. Firms with clear systems in place will be well placed to take on this work confidently.

With thresholds confirmed and EOPS removed, the framework for MTD ITSA is now settled. The coming months are a critical time to be finalising preparations. Firms that identify in-scope clients, utilise Smart Task Templates and align internal processes now will be ready when the first quarterly updates fall due on 7 August 2026.

For authoritative information:

https://www.gov.uk/guidance/use-making-tax-digital-for-income-tax/

https://www.gov.uk/government/collections/making-tax-digital-for-income-tax-as-an-agent-step-by-step

If you have any questions about Smart Task templates, or need help creating a new one to cover MTD ITSA, please contact support.

Join the growing number of UK accounting and bookkeeping practices using PracticeFlow to stay organised, meet deadlines, and focus on what matters most.